Pune Property Tax – Step by step process to pay tax online

Property tax is a levy imposed by Pune Municipal Corporation (PMC) on property owners, determined by the assessed value of their real estate. It’s an annual tax used to finance public services and infrastructure projects such as schools, roads, and emergency services. The tax amount is calculated by multiplying the property’s assessed value by the applicable tax rate set by the local government. Rates and assessment methods vary by location and local regulations. Property owners in Pune are required to fulfil their obligatory duty by paying property tax. The Pune Municipal Corporation (PMC) serves as the official administrative entity entrusted with the responsibility of collecting property tax for residential, commercial, and institutional properties in the city. The revenue thus gathered is employed by the PMC to offer a range of civic amenities to the residents of Pune.

Pune property tax online: How to pay?

One can pay the property tax online by logging in the official website of Property Tax Department, Pune Municipal Corporation at https://propertytax.punecorporation.org/index.aspx

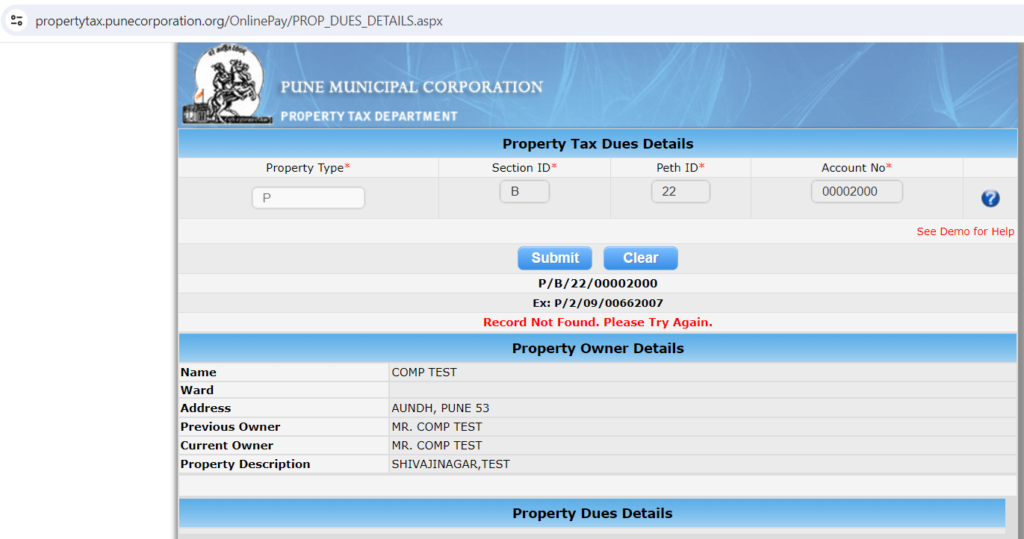

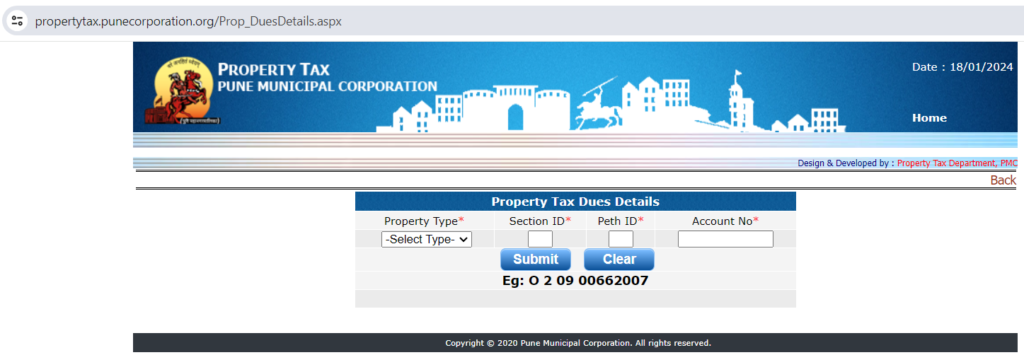

On this page click on PAY ONLINE, second box. You will be redirected to new page – https://propertytax.punecorporation.org/OnlinePay/PROP_DUES_DETAILS.aspx

On this page select ‘Property Type’ from the dropdown box. Enter ‘Section ID’, ‘Peth ID’, and ‘Account Number’, and click on Submit button. Once you submit, you can see details like Name, Ward, Address, Previous Owner, Current Owner, and Property Description.

Property Type, Section ID, Peth ID and Account Number you can get from the Pune property tax bill.

You will see details like below screen.

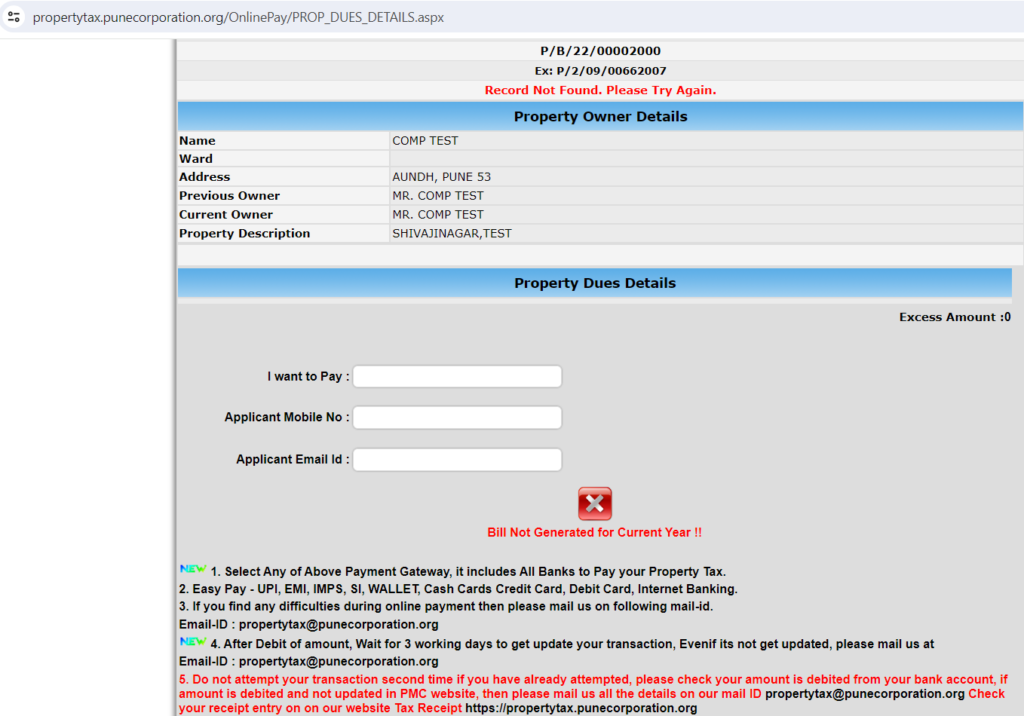

To make an online payment for Pune property tax, input the specified amount in the ‘I want to Pay’ box, provide the applicant’s mobile number and email ID, proceed to choose the preferred payment gateway, and finally, click on the ‘Pay Online’ option.

To settle your Pune property tax through NEFT/RTGS Payment, opt for the NEFT/RTGS Payment alternative on the Pune property tax homepage by clicking on back button or visiting home page link mentioned in above step.

To make payment you can use multiple online payment options like Google Pay, Phone Pay etc.

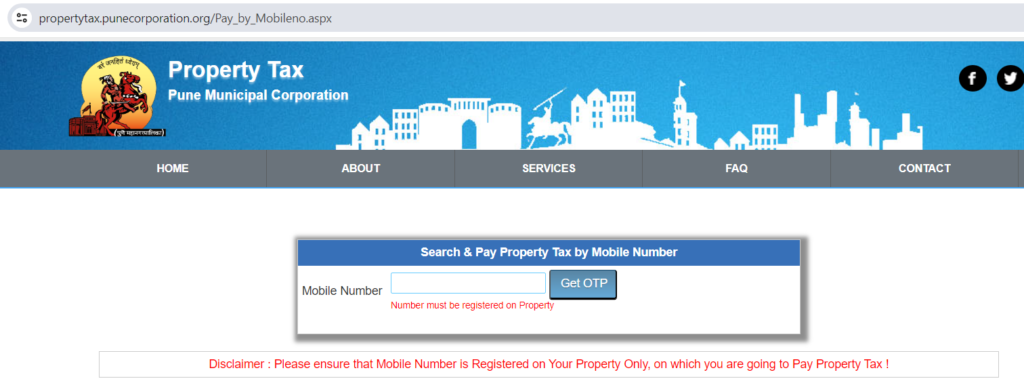

Pune property tax: How to pay using your mobile phone number

If you happen to forget your property ID, you have the option to retrieve your Pune property tax details by searching using the registered mobile number. Once you locate your property details, you can proceed to pay your Pune property tax bill.

Visit – https://propertytax.punecorporation.org/index.aspx

Click – PAY TAX BY MOBILE NUMBER

This link will open – https://propertytax.punecorporation.org/Pay_by_Mobileno.aspx

Enter mobile number, you will receive OTP number on registered mobile number, enter OTP, you can see Property Tax bill.

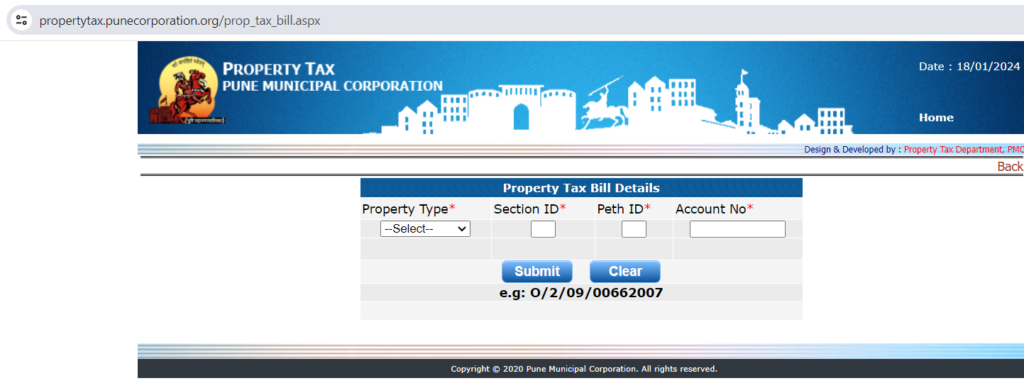

Pune property tax: How to print a property tax bill?

Visit Pune Property Tax Portal home page – https://propertytax.punecorporation.org/index.aspx

Click on “TAX BILL”, New webpage will open – https://propertytax.punecorporation.org/prop_tax_bill.aspx

Enter Property details.

Pune property tax: How to print a property tax receipt?

Goto homepage – https://propertytax.punecorporation.org/index.aspx

Click on TAX RECEIPT option.

Above page will open, enter property details and download your property tax receipt.

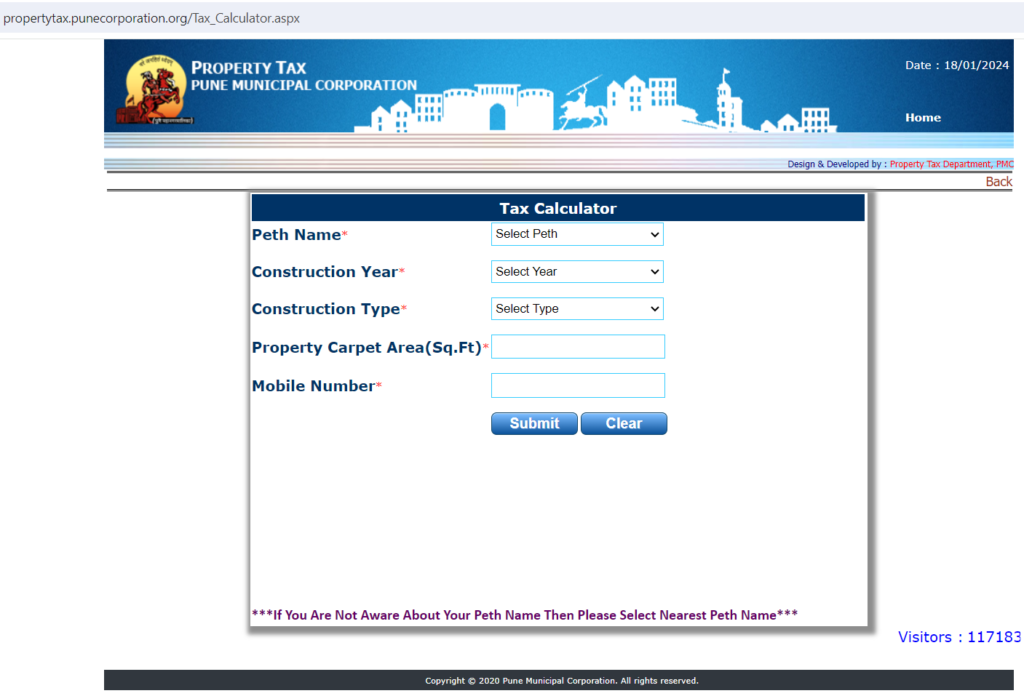

Pune property tax: How to use tax calculator to calculate Pune Property Tax?

The computation of property tax in Pune encompasses the evaluation of multiple factors, including the property type, usage, and age. The tax calculation relies on the capital value of the property, determined through a comprehensive value system. This system considers various parameters such as the base value, built-up area, use category, building type, age factor, and floor factor to arrive at the final property tax amount.

Goto homepage – https://propertytax.punecorporation.org/index.aspx

Click on TAX CALCULATOR option.

This webpage will open – https://propertytax.punecorporation.org/Tax_Calculator.aspx

Choose the ‘Peth Name,’ specify the ‘Construction Year’ and ‘Construction Type,’ input the ‘Property Carpet Area (Sq Ft),’ and provide your mobile number. Afterward, click on ‘Submit.’ If you are unsure about your ‘Peth Name,’ you can select the nearest option available.

Pune Property Tax: Grievance Redressal

For issues related to Pune Property Tax, mail at [email protected] or call 1800 1030 222.

FAQs about Pune Property Tax:

What does Pune property tax entail?

Pune property tax is a mandatory charge imposed by the Pune Municipal Corporation (PMC) on property owners within the city. It serves as a compulsory financial contribution utilized to support the PMC in providing civic amenities.

How is the calculation of Pune property tax conducted?

The computation of property tax in Pune is based on the capital value of the property. This process incorporates factors such as base value, built-up area, use category, building type, age factor, and floor factor.

Is it possible to make Pune property tax payments online?

Absolutely, Pune property tax payments can be conveniently made online through the official Pune Municipal Corporation website, providing property owners with ease of access.

What should I do if I forget my property ID when paying Pune property tax?

In case you forget your property ID, you can retrieve your Pune property tax details by searching using your registered mobile number on the PMC website before proceeding with the payment.

How can I make Pune property tax payments for properties located in the recently added 23 villages?

To make payments for properties in the 23 newly incorporated villages, simply click on the ’23 Villages Online Payment’ option available on the Pune property tax homepage.

Do different tax rates apply to residential and commercial properties in Pune?

Yes, Pune property tax rates do differ for residential, commercial, and institutional properties, with rates being determined based on the specific type and usage of the property.

What if I am uncertain about my ‘Peth Name’ for Pune property tax payments?

If you are unsure about your ‘Peth Name,’ you can opt for the nearest available option while entering details for your property tax payment.

Can NEFT/RTGS be used to pay Pune property tax?

Certainly, property owners have the option to utilize NEFT/RTGS for Pune property tax payments, and they can select this payment method on the Pune property tax homepage.